The partners usually do not spend us to make certain favorable analysis of the products or services. We have found an introduction to the huge benefits and you can drawbacks out of Pursue Bank account bonuses. Chase Personal Customer Examining gives the large incentive at the lender. You can generate a cash bonus all the way to $step 3,one hundred thousand after you discover or upgrade in order to Chase Private Buyer Checking by the July 16, 2025. We work tirelessly to share with you thorough research and our honest feel that have products and names. Naturally, private money are personal thus anyone’s sense can vary away from someone else’s, and you can estimates according to prior performance do not be sure future efficiency.

Discover Cashback Checking – to $360 added bonus

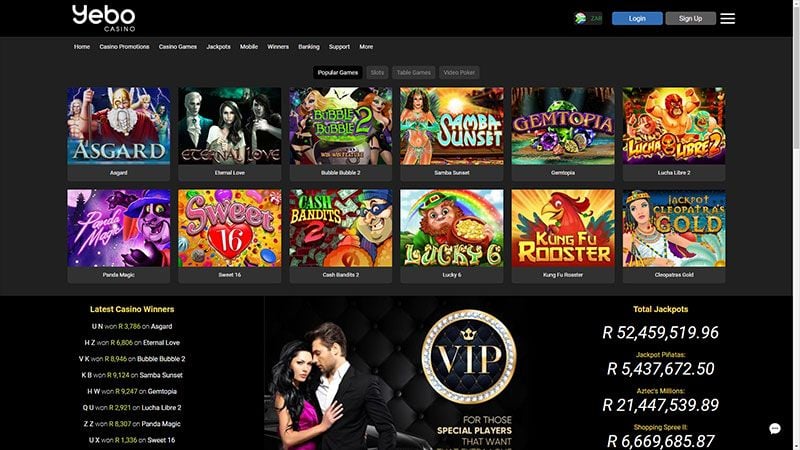

Chase Safer Financial is made for those people who are unique in order to financial or have experienced monetary struggles before. As the $4.95 month-to-month service percentage implies that your bank account obtained’t end up being free, it does feature several beneficial dracula slot game review advantages, along with zero overdraft costs. And, customers access Chase’s greater footprint away from twigs and ATMs. Readily available primarily from the SouthEast, Very first Horizon Bank has to offer as much as an $650 acceptance bonus when you unlock a new company family savings and make dumps. The first tier incentive out of $400 is for finishing put needs. If you possibly could done a bona-fide head put from the workplace, that’ll function as proper way to meet the new head put demands.

- When you done these types of tips, Chase often deposit the advantage cash to your the fresh account in this 15 months.

- Lender away from nearly anyplace because of the cell phone, pill or computer and most 15,one hundred thousand ATMs and more than 4,700 branches.

- See your membership contract and you may commission agenda to learn more.

For many who open a different bank card with indicative-right up extra, yet not, the program alone make a difference the score. And, needless to say, using on the cards can help otherwise harm your credit score, based on how you utilize they. Head over to Alliant’s site and pick sometimes a certification from deposit otherwise an excellent high-produce bank account to begin. Be assured understanding that having Alliant, both our certification and you may high-produce savings account is actually federally insured from the NCUA up to $250,000.

Pursue Total Examining membership costs

It’s in addition to difficult to know exactly just how in the near future your’ll be able to cash-out your bonuses. It could take many techniques from a short while to a few days, depending on the particular give. As well as, Binance claims that you need to fulfill particular requirements (elizabeth.grams., trading a minimum count otherwise looking after your take into account a particular period of time) before you can withdraw your added bonus money. Find out more for the Frequently asked questions webpage of one’s Binance site, that offers more information in the withdrawals. You don’t want to spend some money with regard to they, which’s far better see the brand new product sales you to definitely better suit your lifetime and requirements. So you can, we’ve collected a list of the best subscribe also provides and you can what you you must know to choose whether they’lso are worthwhile for you.

Attract more Professionals That have SoFi Along with

Chase users may well not sign up using offers membership; a qualified Chase consumer otherwise business savings account is needed, and may also features its account charges. Fund are usually made available within a few minutes when the recipient’s email address address or You.S. mobile number is already enrolled with Zelle (go to register.zellepay.com to gain access to acting banking companies). That said, in this post, we’ll go through the step-by-action tips you could potentially go after to earn your own Chase examining and you will savings account incentives. That it give makes you choose a checking account that actually works right for you — from very first (and no minimum balance specifications) to several degrees of advanced.

Prior to signing up to possess a different membership to make a lender added bonus, see the info in addition to what costs might possibly be incurred and just how long you might have to wait for the added bonus becoming paid off. Looking lender incentives try an art itself, however in general, try to analysis individual lookup to get bank account incentives. For many who’re also attending to, it is wise to be able to find dozens of family savings bonuses each year. Bank bonuses will likely be intimidating, so my suggestions to somebody, particularly if you’lso are not used to which, should be to take it slow.

It is also really worth listing you to definitely Pursue Bank often amount your brand-new account incentive because the interest and report they to your Internal revenue service thru Mode 1099-INT or Mode 1042-S. A great many other platforms for trade shares, ETFs, alternatives, crypto, or any other form of property will give you join bonuses well worth less than $twenty five. Including, Robinhood constantly now offers a good $5 incentive (although a few lucky consumers could possibly get $twenty five or even more). Another similar software, MooMoo, will give you 100 percent free carries really worth at the very least $10 once you put at least $one hundred inside an alternative account together (although there’s a chance you’ll overcome $twenty-five really worth).

That it bonus is a great alternative if you want to open a corporate checking account from the a primary lender and certainly will fulfill minimal put and you will equilibrium conditions, in addition to over a few purchases. This is actually the simply organization account on the all of our checklist, also it’s a talked about as it consistently now offers a plus and you may will come from of one’s biggest banks. To compare, find all of our set of the best team account offers. Keep in mind that you’ll have to do the search to determine and this accounts cause the fresh head deposit standards. Doctor from Borrowing from the bank has a list of investigation issues for just what leads to the newest lead deposit for various bank accounts, but this can change-over go out, which’s not always 100% exact. A couple of times, you’ll have to send numerous ACH transfers in-and-out of your bank account and you will guarantee that one causes the fresh head deposit needs.

The newest account also provides no account charges, a remarkably higher produce in your balance with no-commission overdraft publicity. To own membership opened on the non-working days, sundays or government getaways, the new open go out is regarded as the second working day. Consider the firm Basics Cost Advice File to possess a list of charge. However, perhaps you’re trying to find banking together with your local credit union, starting a small business savings account, or exploring investment accounts. At some point, going after multiple checking account bonuses is not illegal, and you may financial institutions did research to the Return on your investment out of offering the added bonus even factoring inside the churners. However you might be troubled as a consumer to own one account you discover.

They are not intended to offer tax advice or monetary planning when it comes to every facet of a customer’s finances and do not is assets you to customers get keep away from Nuclear Purchase. For much more factual statements about Atomic Invest, delight see the Function CRS, Setting ADV Part 2A, the brand new Privacy policy, or any other disclosures. Continue reading to find out solutions to commonly questioned questions relating to savings account bonuses or any other financial campaigns. Only a few banking companies tend to pull the ChexReport and not each one of them usually declaration a new checking account to the ChexReport. Specific financial institutions are just what we phone call “chex sensitive,” meaning that, for those who open up so many bank account inside the a short time period, you could be declined a new family savings. So it extremely doesn’t provides much simple effect and most financial institutions wear’t be seemingly chex sensitive.

While the an excellent Pursue Safer Financial customers, you’re permitted take part in the brand new Send-a-Buddy system. You could ask your friends to open a qualified Chase examining membership playing with an alternative recommendation connect you demand online. You can make $fifty per advice who opens up a being qualified membership—as much as a maximum of 10 times for each and every twelve months. Opening an excellent Chase Secure Bank account setting you ought to invest in a $4.95 fee every month, that financial often deduct out of your balance.

Although some of them also provides have time limits, they’ll likely be used up with comparable offers. For many who’re trying to find freebies, we’ve discovered a few of the quickest ways discover incentives value $twenty-five or even more having join offers and you may similar campaigns. Below are a few the listing in addition to product sales from benefits programs, financial characteristics, broker programs, and much more. You’re just entitled to you to definitely checking account cash bonus; you can’t unlock multiple examining accounts and you will receive several bucks incentives. The brand new promo code is used on the original family savings one are open ranging from Get 5, 2025 and you will Sep 8, 2025. Date step one ‘s the time you unlock your account and you can begins the newest record months.