Articles

Our demanded $step 1 deposit gambling enterprises for new participants provide a welcome added bonus one you can benefit from once you sign up. If you’d like to make interest for the all deposit balance, the lending company also provides an aggressive rewards bank account. You to family savings can be found simply to customers with an American Display mastercard. For individuals who’re also currently a credit card user, otherwise plan to be, it lender now offers a whole plan using its examining and you will deals options. For many who’re also only trying to find savings, the newest large-yield family savings is still worth considering.

Latest development to your large-give family savings rates

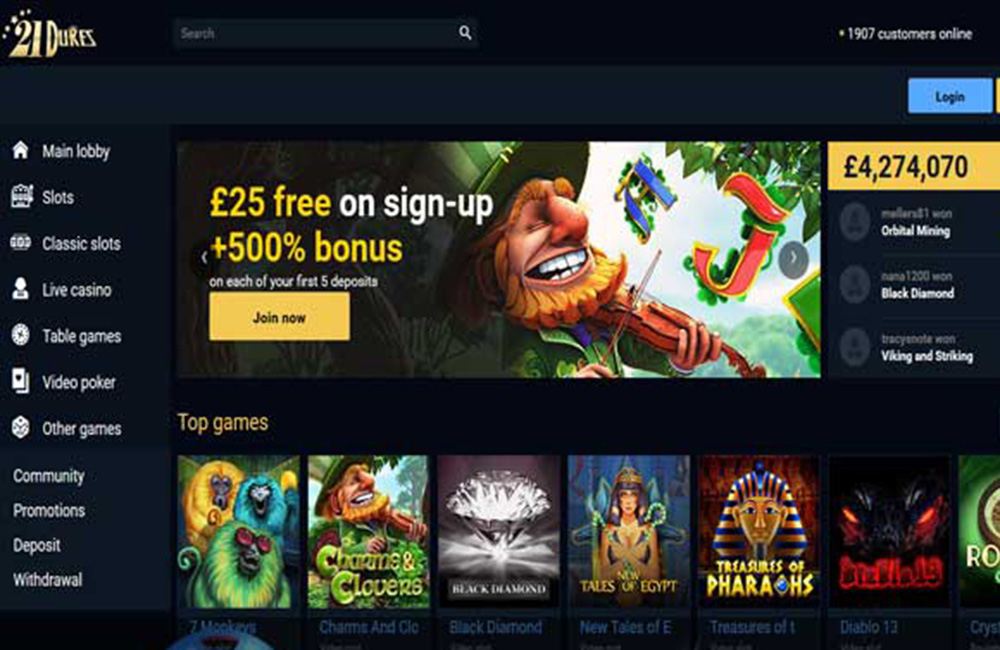

The brand new Dawn Ports VIP System strives to prize loyal people having nice advantages and you may smaller services. The newest 30x betting needs applies to both your own deposit and you will extra amount. When you deposit $100 and also have a $2 hundred bonus, you’re deciding on betting $9,100 prior to detachment. The advantage merely deals with harbors and keno – you will need to play black-jack therefore’ll gap everything you. The new local casino also offers other kinds of welcome incentives, such as the 150% match bonus, relevant to table video game and you may electronic poker.

Tax payable to your prohibited assets

With a high-yield offers accounts, you deal with changeable APYs https://vogueplay.com/au/davinci-diamonds/ in return for being able to bring your money aside whenever you want. The best Computer game prices are presently outpacing one another highest-give discounts profile and inflation. Openbank also offers an individual membership — an FDIC-insured savings account who may have a high-notch annual commission give (APY). There are not any month-to-month charge, which is regular out of on line financial institutions, but there is the absolute minimum deposit element $500. Certainly one of 370 savings profile out of 157 banks and you will borrowing from the bank unions, i discover the new Synchrony Highest-Give Checking account becoming an informed highest-give checking account. A superb step 3.80% yearly percentage yield (APY), partners fees, strong customer support and you may access to ATMs make account stand out.

The following profile is available at the most banking institutions and you will borrowing from the bank unions. They’re federally insured for approximately $250,100 and offer a comfort zone to place your currency while you are getting focus. Matched up incentives try whenever a gambling establishment fits their put that have bonus finance. Including, for individuals who deposit $10 and the render are a a hundred% bonus fits, you can aquire a supplementary $ten on your account.

As to the reasons Basic National Financial of The usa?

The fresh FDIC decides whether these types of requirements try satisfied at that time from an insured financial’s inability. The brand new FDIC brings together for each co-owner’s shares of the many combined profile during the bank and guarantees per co-owner’s total up to $250,100000. The fresh Partner’s ownership share in most joint accounts from the financial means ½ of your shared account (or $250,000), therefore his display is fully covered. The fresh Partner’s control show throughout joint accounts at the bank equals ½ of your combined membership (otherwise $250,000), thus the girl show is actually totally covered.

Additionally, you could start to try out it thrilling position for a dollar. The brand new Wild Life animal-inspired position of IGT also offers something for all. With its easy game play and you will restricted regulations, you’re guaranteed a delicate and you will enjoyable sense up against a vibrant safari backdrop. This video game is good for low money professionals, featuring the absolute minimum risk out of simply $0.01, allowing you to gain benefit from the excitement of your own crazy as opposed to breaking the bank.

Even though this helped to attenuate the excess TFSA matter out of $7,five-hundred so you can $500, it did not totally consume they. Francine proceeded for an excess TFSA quantity of $five-hundred in her account as a result of each one of 2024. She was required to shell out a taxation from $60 on the season 2024 ($five hundred × 1% × one year). Once and then make $7,500 share for the Summer 25, 2023, Francine got an excess TFSA amount of $7,500. The greatest too much TFSA matter one remained within her membership is actually $7,five hundred for each and every month of Summer to help you December. For a price of just one%, it indicates she was required to shell out $525 within the income tax on her behalf an excessive amount of on the seven days the brand new a lot of stays ($7,five-hundred × 1% × 7 months).

Inside a traditional checking account at the 0.01 % APY, you are able to earn to one dollar. The original revolution from about three lead money was released within the a matter of days for the bank accounts from qualified Us citizens. Oct 2, 2024After half dozen consecutive household of refuses, All of us financial deposits rose in the last quarter of 2023. The newest streak away from refuses are caused by the usa Federal Reserve’s decrease in the harmony layer (called quantitative toning) while increasing inside the rates, spouse Szilard Buksa and you may acquaintances determine.

Typically, such as systems is actually intended for consumers who aren’t searching for paying large, and therefore high-rollers can be a little disappointed because of certain lacks and limitations. That’s correct, you’ve read it really- there are a bunch of systems offering participants a chance to winnings one thing even if they make less deposit. But really, you should know one possibly anything turn into a bit spoiled within the attractive skin, therefore you should always strategy carefully and choose wisely.